Easy Ways To Minimise Household Costs

Easy Ways To Minimise Household Costs

Feeling The Financial Pinch? You Are Not Alone

If you are feeling the financial pinch, you are not alone. From fuel and energy costs to household necessities, everyday living costs have been on the rise recently and it can be overwhelming.

"The cost of living for the average household, as measured by the household living-costs price indexes, increased 7.4 percent in the June 2022 quarter compared with the June 2021 quarter". Stats NZ

In this article we look at what can you do to practically lessen the impact and save some costs for your households on an ongoing basis.

Tips To Reduce Household Costs

Switch power, phone and internet companies

Are there better value options available? It is worth regularly reviewing the market to see what promotions are being offered, comparison websites make reviewing options a breeze.

Home energy loans

A number of banks are currently offering loans such as ANZ, Westpac and Kiwibank, with very low, fixed rate interest costs (some as low as 1%) to install or replace energy efficient products in your home creating a warmer, healthier, more energy efficient home with less impact on the planet. These low rate options include products such as heat pumps, ventilation, insulation, double glazing, electric vehicles and chargers as well as solar panels and batteries. The team at Loan Market Agile on 0800 124453, are on hand to explain the options.

Track your expenses

Review your bank and credit card statements to see how much non-essential spending you’re doing, you may be shocked by the results. This will help you pinpoint areas where you could reduce spending with little effort. If you save $100 per month, that’s $1200 per year!

Cancel monthly subscriptions

Do you have subscriptions you no longer need? Magazines, gym, viewing subscriptions? If they are no longer needed, cancel them.

Credit cards

Banks offer different credit card terms; it may pay to investigate whether there are lower cost options currently available.

Insurance

Review current insurance costs against alternative providers, consider car insurance, along with health and family insurance cover options.

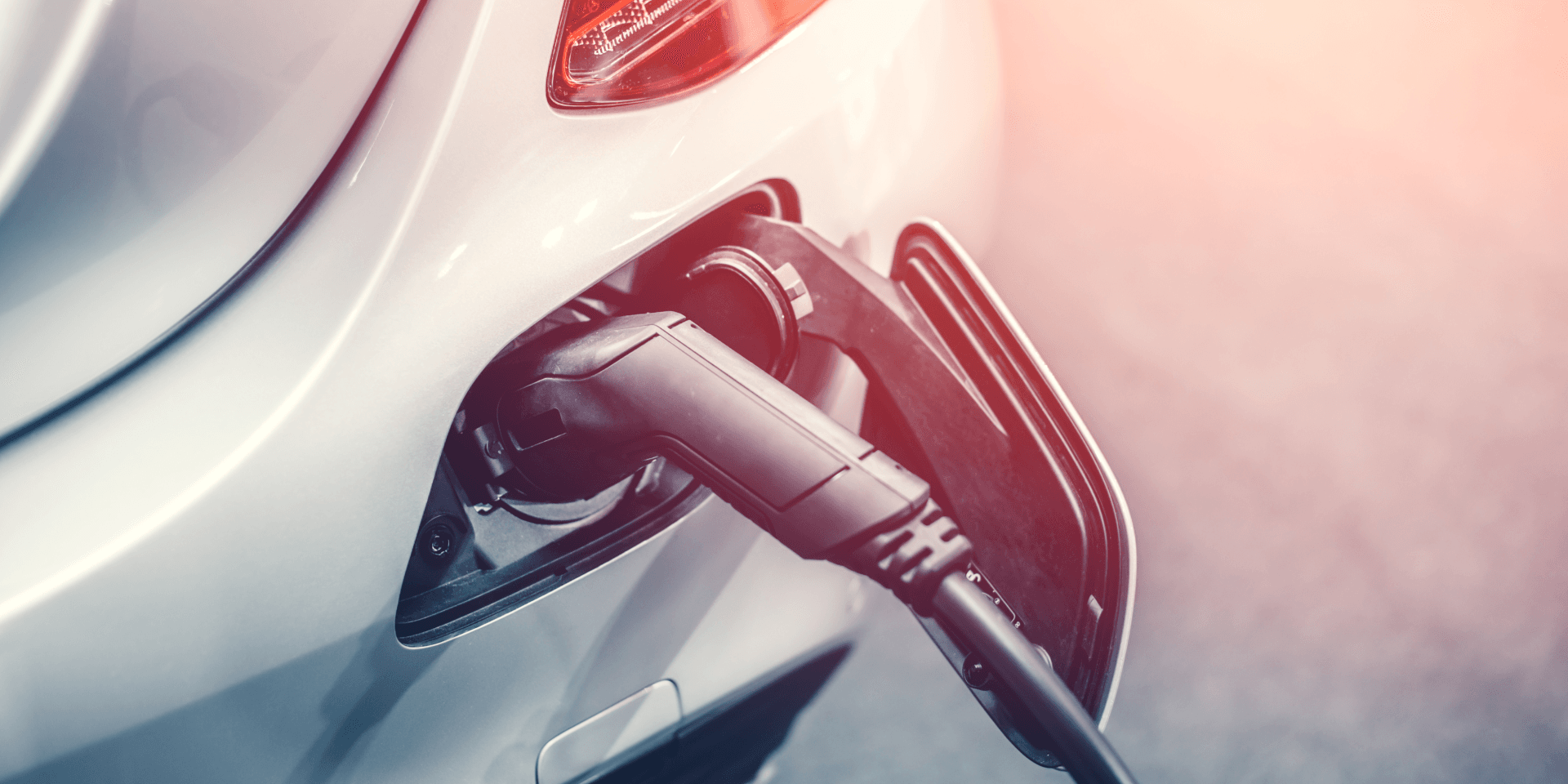

Switch to an electric vehicle

Cost of fuel an ongoing concern? When you are next replacing your car, consider a change to a hybrid or all electric vehicle (EV), the cost of EVs has dropped considerably and EV chargers are simple to install in your home - they even come with solar options.

Take lunch to work

A simple, but often effective way of saving money throughout the week (probably helpful to the waistline too)!

Use a budgeting app

There are a number of budgeting apps available, a selection is listed here.

Swap paid activities for free ones

If you have a family, activity costs soon add up, but Christchurch is a fantastic place to live, with many free activities available, check out some suggestions

here.

Solar power

If you want to lower the cost of your power consumption with a renewable energy source, solar power is the way to go, talk to your local solar power specialists, Christchurch Electrical Solar about installation options for your home, business or off-grid property.

Spread the cost

Finance providers such as GEM Finance can help spread the cost of your purchases such as heat pumps, LED lighting and solar panels, with interest free payments.

Whilst it can be daunting to tackle topics such as household budgeting and finance, taking a look at one small area at a time, can be far more manageable and have a substantial impact on reducing annual living costs – just imagine what the impact could be when you tackle multiple!

Share article: